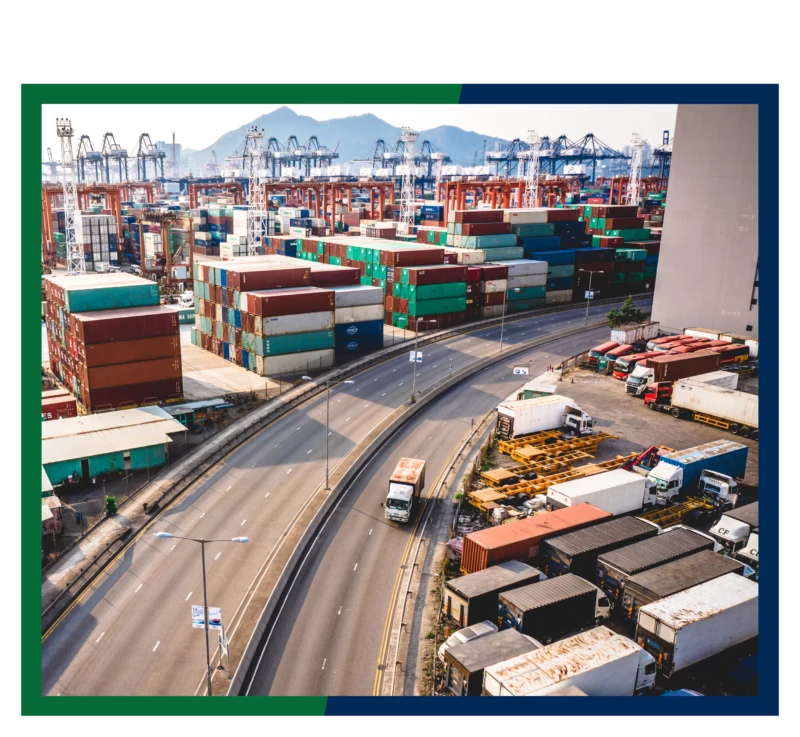

Trade Finance

WSFS Capital Markets can help establish and improve trade cycles and bridge payment gaps for companies with exposure to international supply chains.[1] Whether you deal with counterparties through open account or through documentary trade instruments, WSFS can help structure your global approach to managing risk.

Key Features of Trade Finance

Standby Letters of Credit

Standby letters of credit can be used to support a variety of performance or financial obligations in fields such as construction, insurance, energy, leasing and trade.

Importer and Export Letters of Credit

Navigate new markets while mitigating risk and increasing global sales.

Documentary Collections

Trusted intermediary for delivery of commercial documents in accordance with instructions provided by your suppliers.

Bankers’ Acceptance

Importers can obtain immediate cash flow by reselling their goods before payment is due.

Other Solutions