What is a Standby Letter of Credit?

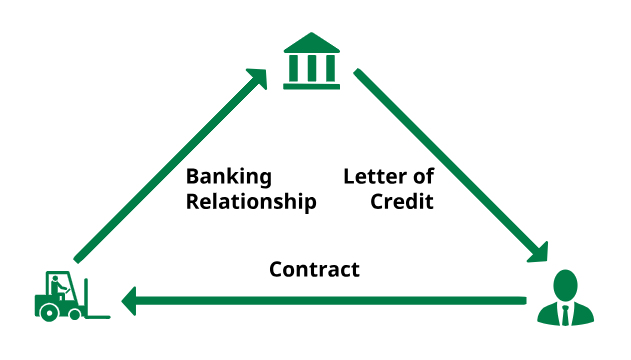

A standby letter of credit supports the performance of contractual arrangements between two parties. The letter of credit is an independent obligation taken on by the issuing bank. The issuing bank commits to pay the beneficiary of the letter of credit in the event the contractual arrangement is not performed per its terms. Standby letters of credit have many applications but are often used in lieu of cash deposits. Commercial tenants commonly look to standby letters of credit to offset the need for a security deposit on long term leases. They are also acceptable substitutes for bid bonds, performance guarantees, and warrantee bonds when submitting contract bids.

Standby letters of credit are also leveraged as credit enhancing vehicles to receive working capital or advanced payment to finance start-up costs or materials associated with manufacturing or other cost-heavy projects.

International or Domestic payment guarantee ensuring performance of contractual obligations.